The steep increase in the price of oil in 2019 was supposed to ignite inflation. The corona led to a correction in the market Prof. Ziv Reich claims that the correction is too strong

China was the first to announce the blockade and being a world oil importing power, the result was a drop of over 20% in China's daily demand for oil barrels. The quarantine imposed on the economy of China, the world's largest oil importer, dropped the daily consumption of barrels by 20% in January.

This shock was the first of the dominoes that create a significant movement on the oil producers, including the economy of the Arab Gulf countries.

Another step included the cancellation of flights and the cessation of mass production in China's factories also significantly lowered the demand for oil and the immediate equation of this is a decrease in demand = a decrease in price. Factually, it can be noted that during January the prices of the various barrels fell between 12%-15% when a new level of $40 per barrel was on the horizon and today sounds like a reasonable level.

China is the largest importer of oil in the world and its consumption is estimated at 15 million barrels per day. Therefore, when the Chinese market is unstable, this affects the entire activity of the global oil market. Last year, Chinese oil imports jumped by more than 9%, to about 10 million barrels a day. Moreover, in the last two months of 2019, before the outbreak of the Corona crisis, record imports were recorded with approximately 11 million barrels per day in November and approximately 10.8 million per day in December. Considering estimates for the solution to the trade crisis with the US, the outlook for the oil market was positive. However, the estimates did not take into account the appearance of the new virus and the strength of its impact.

Actions such as a horizontal cut in the supply of oil are not certain to have an effect in the immediate term and its signals will be manifested only in the medium term and hence beyond the health risks brought by the corona virus, the impact of which on the oil-producing Arab countries is already evident, which led OPEC, which is the joint body of the oil producers, to gather and examine other options to stop the incessant decline in oil prices.

Today, the consequences of the Corona are increasing and increasing when many airlines have stopped their activities to certain destinations due to economic unviability and it seems that the reduction of oil shipments to China, to the airlines and to various factories is such that only a drastic reduction in oil production can affect the supply and demand equation, all this in combination with the creation of long-term contracts which will ensure a significant long-term reduction such that it will have a real effect on the price, stabilize it first and later lead it to a moderate increase.

Here is the place to mention that oil prices have risen since the beginning of 2019 by tens of percent and reflected high demands reflecting a stable economy and the positive signs of the global economies pushed the price of oil upwards and there was even great concern that there would be a significant increase in inflation and at the end of the day there would be a high price which would significantly increase the prices of basic products and the shock from a high oil price is significant for the economy so the corona effect is a correction that the oil price needed but the correction is too aggressive, too fast and may harm the economies of those oil producing countries also the damage will be rapid in the emerging markets but on the other hand various indices such as the consumer price index Consisting of a mix of goods and prices will drop significantly and lower the cost of living but again too fast a drop will create a problem for those manufacturing businesses who will suffer from a difficult and challenging cash flow.

In addition to this, the wave of alternative energy which has gained a lot of sympathy over the many years and has received many advantages in terms of reduced taxation and additional regulatory reliefs seems to lose its prestige if the price of oil continues to fall and even remains at a low price.

professor Ziv Rich He is the Dean of the School of Insurance at Netanya Academy

More of the topic in Hayadan:

Why do so many epidemics originate in Asia and Africa - and why can we expect more such epidemics in the future?

What is the corona virus and why is it dangerous?

Oil-degrading bacteria

2 תגובות

Unfortunately, the article does not describe well the oil market and the factors that affected it this year:

1) Oil prices have been in decline for a long time, the reason is the large oil output of the United States and mainly the oil shale.

2) Oil prices have fallen below $50 per barrel in recent years and this has resulted in a strong decrease in the profits of Saudi Arabia and Russia.

3) The OPEC countries were unable to reach an agreement on a cut in output which was intended to stabilize prices to a range of $50 per barrel, and the Soviet Union in particular opposed the cut requested from it.

4) Saudi Arabia in response decided to flood the market with another 2 million barrels per day to further impoverish the Russians and also the oil shale industries, which pushed the first drop to $30 per barrel.

5) Then came the corona epidemic and global demand dropped by about 25 million barrels per day, which brought oil to values of about $20 per barrel.

6) The Ofek+ countries finally agreed on a cut in output of about 10-12 million barrels per day, however, as stated, this is far from offsetting the drop in demand, and the market did not react at all.

7) The oil companies in the United States, especially the shale industries, are therefore in a severe crisis and many of them are on the verge of bankruptcy.

8) If another cut does not happen soon in the order of 10 million barrels per day, the market will be saturated within a few weeks and there will not even be a place to store the excess oil, this will lead to a market failure, and widespread bankruptcies of the oil industries in the world.

9) The United States is aware of the problem, but it is in a trap, its excess production gives it energy independence and it is not dependent on the Gulf countries and the political situation in the Middle East, this situation will change when the shale companies collapse, therefore it has no desire to cut production.

Hope the explanation is clear to all.

If all the sorrow for the lives of the people who were affected

It turns out that the virus has positive effects

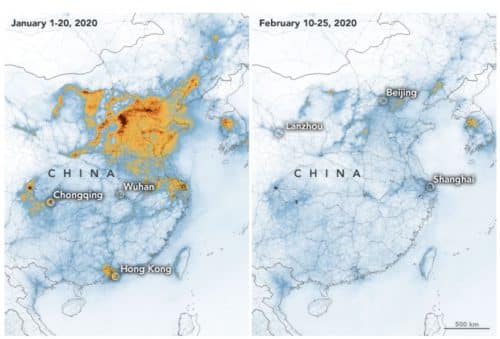

- As a direct result of stopping flights, travel and industrial activity, there is a significant decrease in air pollution and the emission of pollutants such as DETH and methane,

- A decrease in global economic activity and the blocking of transitions between countries will moderate the madness of globalization and perhaps bring the world closer to more sane behavior,

- The fear of eating animals from the wild will moderate the damage to the variety of species,

- Even if it sounds terrible and even if it is not the desired way, the thinning of the global human population will not harm,

It is clear that for each and every one adhesion

The virus is a trouble and a risk, but maybe

From Covid19 salvation will come to the environment

and for human population,

Cruel ? Bad ? But true!