The Innovation Authority and the PLANETech community publish for the first time the climate innovation report for 2021; Most of the world's largest climate funds do not invest in Israel * According to the climate report, the significant challenge for climate tech companies is finding financing for the project, along with difficulties in the "scale-up" phase, finding a beta site, and regulatory barriers

Although the climate crisis is felt in Israel perhaps more than in other parts of the world, the backbone of Israeli industry - the high-tech industry - is reluctant to develop solutions to the climate crisis.

The Innovation Authority and the PLANETech community publish for the first time the climate innovation report for 2021; Most of the world's largest funds in the climate field do not invest in Israel * According to the climate report, the significant challenge for climate tech companies is finding financing for the project, along with difficulties in the "scale-up" stage, finding a beta site, and obstacles regulatory. The report shows that about 10% of the high-tech companies established in Israel in the last year are developing technologies in the field of climate

Dror Bin, CEO of the Innovation Authority: "The climate crisis is the most significant global risk facing humanity today. While a wide variety of actions are being taken at the interstate level, the eyes of the entire world are directed towards the technology, which will produce innovative and ground-breaking solutions to reduce the rate of greenhouse gas emissions and to deal with the consequences of the crisis. Climate technological innovation is not only a significant pillar in the fight against the climate crisis, but also a significant business opportunity for the growth of an innovative, diverse and sustainable technology industry."

Uriel Keller, CEO PLANETech: "The report we compiled places Israel as a world leader in climate technologies, and puts a spotlight on areas in which Israel has unique potential. Israeli entrepreneurs who will develop solutions and technologies in the field of climate, will build a new generation of unicorns in Israel, and will help face the greatest challenge to humanity. The vision of PLANETech and its partners is to turn Israel into a global center for climate technologies that helps reduce greenhouse gas emissions in Israel and abroad."

The Innovation Authority, in cooperation with the PLANETech community, a joint venture of the Israel Institute for Innovation led by Dr. Yonatan Menuhin and the Consensus Business Group led by Vincent Tchenguiz, are publishing today (Thursday, October 18.10) for the first time the report "Climate technologies in Israel - 2021 situation, Which examines the state of the Israeli innovation industry - its current contribution and its future potential - to the global fight against the climate crisis. Meanwhile, the report maps the innovative technology companies that offer a solution to one or more of the climate challenges the world is facing.

Main findings from the report:

- According to the data of the report, starting from 2014 there was a jump in the number of new start-up companies in the climate fields in Israel, when their number reached a peak in 2016. The proportion of those new climate companies out of all the new start-up companies is growing and rising impressively, reaching 9% of the companies established in 2020.

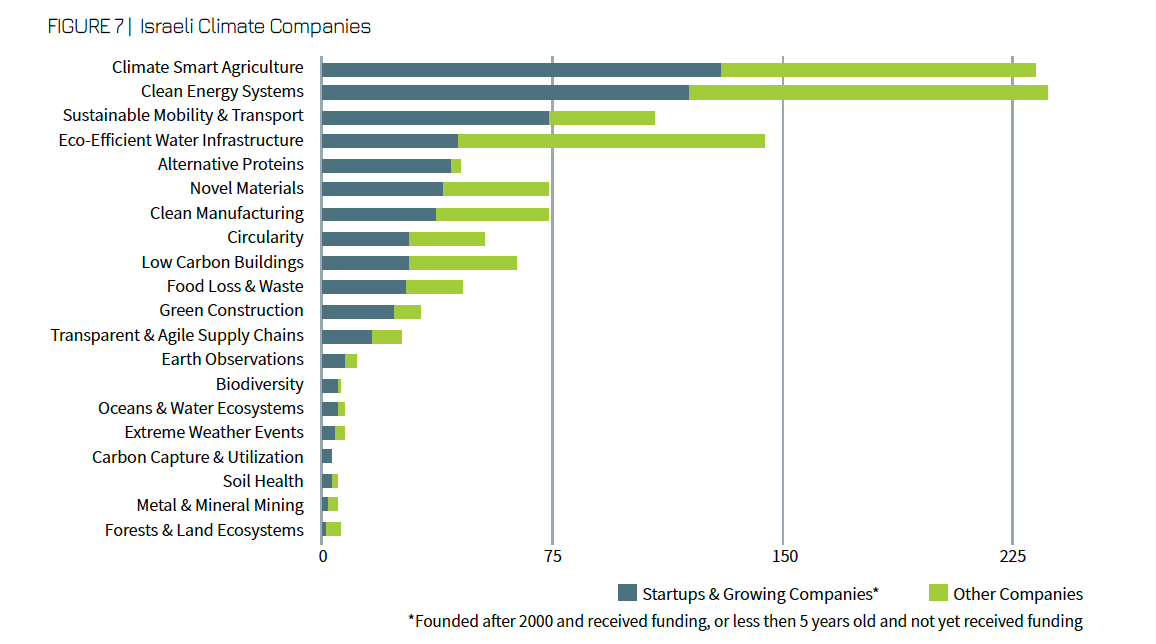

- 637 start-up and growth companies were identified as the companies developing climate technologies, Where the five areas in which the highest number of companies are concentrated are: climate-smart agriculture, clean energy systems, sustainable transportation, environmentally-efficient water infrastructures and alternative proteins. Of these, most of the innovative companies are young, up to seven years old and employ up to 10 employees.

- So far, over 560 private investment entities have invested in Israeli climate companies, most of them venture capital funds, of which about two-thirds of the investment bodies are foreign.

- Those entities invested a total of 2.97 billion dollars in the years 2018-2020. The total investments in the first half of 2021 reached 40% of the total investments in the last three years.

- Yet, Of the 20 leading investment bodies in Israeli climate technologies, there is no dedicated body for climate technologies.

- In the years 2018-2020, the state - under the leadership of the Innovation Authority - invested a total of 280 million dollars in promoting research and development in the field of climate.

- In a special survey conducted for this report, in which nearly 200 Israeli climate companies participated, it was found that The most significant challenge for Israeli climate companies is financing the project. 72% of the companies included in the survey stated that access to capital is currently the main challenge facing their growth.

- Israel in relation to the world - Israeli technologies are at the top of the list of countries (20G) activity in the fields of: cultured meat, irrigation systems, precision agriculture and water desalination. Although, Israel is far from reaching its potential as reflected in relatively low participation and success rates in the Horizon program.

- As part of the report, four areas with significant potential for Israeli climate innovation were identified:

- Clean energy systems: 235 companies, of which 119 are start-up companies that raised two billion dollars. Energy storage technologies were identified as having particularly high potential, with 34 start-up companies raising $265 million.

- Climate smart agriculture: 212 companies, of which 130 are start-up companies that raised 950 million dollars. Precision agriculture was identified as having particularly high potential, with 69 start-up companies raising $489 million.

- sustainable transport: 127 companies, of which 75 are start-up companies that raised 1.8 billion dollars. New transportation services were identified as an area with particularly high potential, with 25 start-up companies raising $1.19 billion.

- Alternative proteins: 45 companies, of which 42 are start-up companies, which raised 364 million dollars. The field of cultured meat was identified as having particularly high potential, with five start-up companies that raised 185 million dollars.

Examination of each field according to the proportion of young companies (companies established three years ago at most) and the scope of investments, produces three main groups of technological fields: established fields (a low rate of young companies and a high cumulative investment volume), which includes the areas of clean energy systems and sustainable transportation; young fields (a high proportion of young companies and a low cumulative investment volume) which includes new materials, circularity, food loss and waste; and fast-growing areas, which includes the fields of alternative proteins and green construction.

More of the topic in Hayadan:

- The climate crisis reaches the Nobel Prize in Physics: two of the developers of the climate models and a researcher of complexity won the Nobel 2021

- How does the climate crisis affect children's health?

- In the background of the climate crisis: the Ministry of Economy will provide assistance to Israeli companies that export solutions for recycling and reusing waste in industry